Advantage of Letter of credit to purchase a car from Japan

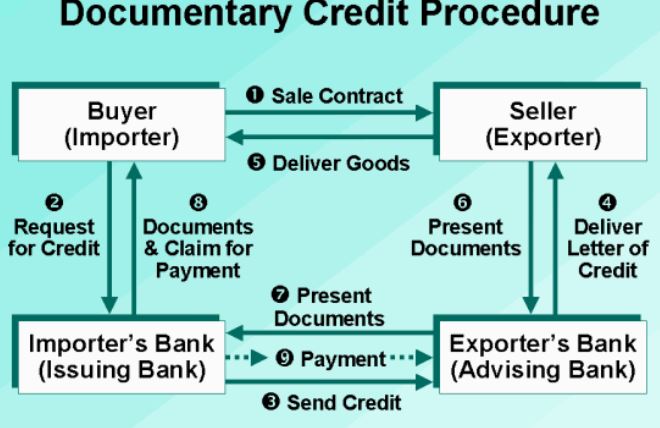

A Letter of Credit or LC is a document submitted by a financial institute such as a bank, guaranteeing a payment. While there are different types of letters of credit, there purpose is to provide security when making a purchase. In case of buying Japanese used vehicles it documents of commitment by the buyer or importer to make a payment to the seller.

The reason why exporters request a letter of credit is because in return to the documents that they provide to prove that their duties are complete within the given time frame, they request for a guarantee that the transaction will happen smoothly. Once the exporters hands over the contract and provide the relevant documents for the vehicle to be supplied within the fixed time frame in return the importer provides a Letter of Credit from a bank or reputed financial institute with a specific amount of money in the stipulated currency.

The exporter is required to submit certain documents such as the Bill of Landing or Airway Bill, purchase invoice, certificate of origin and other literature such as insurance, packaging list etc. A Letter of Credit purchase takes up to 2-3 weeks to complete.

The general details that go in a LC when you purchase Japanese used cars include,

- Name of the applicant (buyer)

- Opening bank (where the applicant opens the LC)

- Negotiating bank

- Quantity of the product and other specifications

- Financial details

- Departure and arrival ports

- Date of shipment

- Validity period of the LC

- Terms and conditions agreed

- Documents to be submitted to importer

Advantages of LC for the exporter

- The seller/ exporter has a guarantee from the buyer/ importer’s bank that the vehicle will be paid for

- Reduce of risk that the importer will cancel the transaction

- An opportunity to receive the payment during the time period when the export is in progress

- The seller is aware of the date when the payment will be released

- The buyer will not be able to defer the payment

Advantages of LC for the importer

- The banks will only release payment to the seller once all the documents mentioned on the LC is submitted

- The exporter is able to control the time period for shipping the vehicle

- The buyer is able to demonstrate is solvency

When you buy from a Japanese auction house you maybe dealing with someone thousands of miles away. The only way you can communicate is through the Internet or phone. In order to make a valid and authentic business transactions exporters use a Letter of Credit. As mentioned above this document allows advantages to both the seller and the buyer to have a smooth and hassle free business transaction even while living thousands of miles apart. Since the banks play an impartial third party role in the business deal, both parties have a safe arrangement.

Only few companies in Japan in used car industry use Letter of Credit transaction. Among them is Japan Motor Co. Ltd. Mostly letter of credit transactions used for Sri Lanka and Bangladesh markets due to country regulation. Japan Motor has an account in one of the most reputable banks in Japan SMBC, which can assist in any types of Letter of Credit as well as cheapest and fastest among other financial institutions.

07.06.2025 / 12:06

07.06.2025 / 12:06